Simply Solar Illinois Can Be Fun For Everyone

Simply Solar Illinois Can Be Fun For Everyone

Blog Article

How Simply Solar Illinois can Save You Time, Stress, and Money.

Table of ContentsOur Simply Solar Illinois StatementsNot known Details About Simply Solar Illinois The Ultimate Guide To Simply Solar IllinoisThe 6-Minute Rule for Simply Solar IllinoisUnknown Facts About Simply Solar Illinois

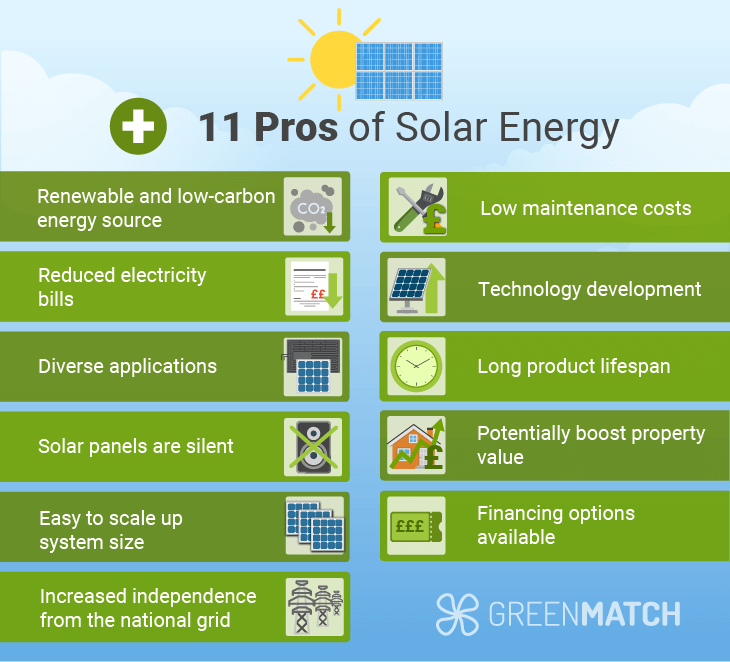

Our team partners with local neighborhoods throughout the Northeast and past to provide clean, budget friendly and reliable power to cultivate healthy areas and maintain the lights on. A solar or storage space project delivers a variety of benefits to the neighborhood it serves. As modern technology advancements and the expense of solar and storage space decline, the economic benefits of going solar proceed to climb.Support for pollinator-friendly environment Habitat repair on infected sites like brownfields and land fills Much needed color for livestock like sheep and chicken "Land banking" for future farming usage and soil high quality enhancements As a result of environment adjustment, extreme climate is ending up being more frequent and disruptive. Because of this, home owners, organizations, communities, and energies are all becoming a lot more and much more interested in safeguarding power supply options that supply resiliency and energy security.

Ecological sustainability is another essential vehicle driver for organizations investing in solar power. Numerous firms have durable sustainability objectives that consist of reducing greenhouse gas exhausts and making use of much less resources to assist decrease their effect on the all-natural environment. There is a growing seriousness to address environment modification and the pressure from consumers, is getting to the leading degrees of organizations.

Unknown Facts About Simply Solar Illinois

As we approach 2025, the assimilation of photovoltaic panels in commercial projects is no more simply an option yet a calculated need. This blogpost looks into exactly how solar power works and the diverse benefits it brings to industrial buildings. Photovoltaic panel have been used on domestic buildings for numerous years, but it's just lately that they're coming to be extra common in industrial building.

It can power lighting, home heating, air conditioning and water home heating in business structures. The panels can be mounted on rooftops, parking whole lots and side lawns. In this post we discuss how photovoltaic panels work and the advantages of utilizing solar power in commercial structures. Power costs in the U.S. are boosting, making it extra costly for services to run and more difficult to prepare in advance.

The United State Power Info Management anticipates electric generation from solar to be the leading source of directory growth in the U.S. power market through completion of 2025, with 79 GW of new solar ability forecasted to come online over the following two years. In the EIA's Short-Term Power Outlook, the agency said it expects sustainable power's total share of electrical power generation to climb to 26% by the end of 2025

The Of Simply Solar Illinois

The photovoltaic solar cell soaks up solar radiation. The visit this site right here cables feed this DC electricity right into the solar inverter and transform it to rotating power (AIR CONDITIONER).

There are several methods to keep solar power: When solar power is fed into an electrochemical battery, the chemical reaction on the battery elements keeps the solar power. In a reverse response, the present leaves from the battery storage space for consumption. Thermal storage makes use of tools such as liquified salt or water to keep and soak up the warmth from the sunlight.

Solar panels considerably minimize energy expenses. While the initial investment can be high, overtime the expense of installing solar panels is recouped by the cash saved on electrical power costs.

The Ultimate Guide To Simply Solar Illinois

By mounting photovoltaic panels, a brand shows that it cares about the atmosphere and is making an initiative to decrease its carbon footprint. Structures that depend entirely on electrical grids are susceptible to power failures that happen throughout bad weather condition or electric system malfunctions. Solar panels mounted with battery systems enable commercial structures to remain to work throughout power blackouts.

An Unbiased View of Simply Solar Illinois

Solar power is just one of the cleanest forms of energy. With lasting guarantees and a manufacturing life of as much as 40-50 years, solar financial investments contribute significantly to ecological sustainability. This change towards cleaner power resources can lead to wider financial benefits, consisting of minimized climate adjustment and ecological deterioration expenses. In 2024, property owners can gain from federal solar tax rewards, allowing them to offset almost one-third of the purchase price of a solar system with a 30% tax debt.

Report this page